Ever wondered how Swing Traders make profit consistently? What are the popular Swing Trading Strategies one can master easily?

To understand this, let’s understand first what Swing Trading is.

In simple words, Swing Trading is a style of trading where positions are held for more than 1 day to even a week. (It can be longer than a week if market swing is for longer period)

Any Swing Trading Strategy looks to benefit from these potential price movement or pattern for a shorter period before price changes direction or momentum decreases.

But how does a Swing Trader decide the holding period of more than a day to week?

We can say, this period is primarily decided by stock’s price swings & momentum.

Let me explain this in detail through this pictorial example of a swing.

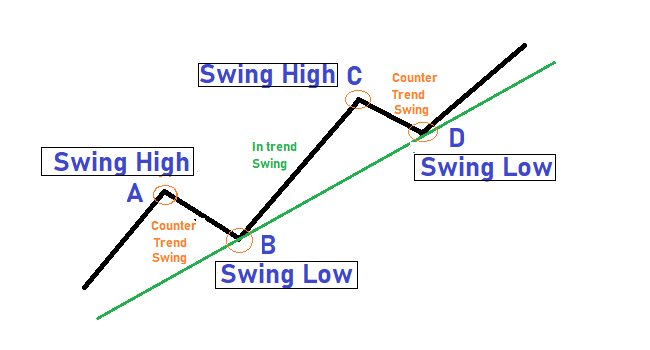

Swing traders look for upward and downward “swings” of Stock’s price movement.

“Swing” could be understood better from the above example of an uptrend where price went through 2 Swing Highs (A and C) and 2 Swing lows (B and D)

As you can see the price does not go up in straight line and takes rest in form of small counter swings (AB and CD) before resuming the uptrend.

Price resumes its trend up through major swings (e.g. BC) in the direction of the trend.

Here in this case, traders could enter near Swing Low price points and exit at Swing High. The time taken for price movement from Swing Low to Swing High defines the holding period of their stock for their Swing Trading Strategy.

For other strategies which involve chart patterns, this time period could be decided according to patterns entry and exit point.

One other key metric Swing Trading Strategy needs to keep in consideration is the Risk Reward of the trade.

Swing Traders look to enter with minimal risk and exits when they achieve their target. So, they assess trades on a risk/reward basis.

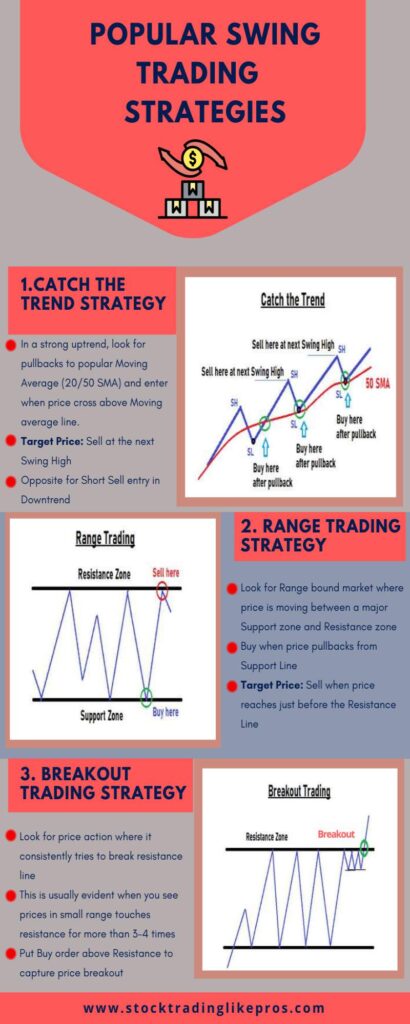

Now that you understood few basics of Swing Trading, let’s understand 3 popular simple strategies used widely by professional Swing Traders

- Catch the Trend Strategy

- Range Trading Strategy

- Breakout Trading Strategy

1. Catch The Trend Strategy

Catch the trend strategy is one of the most popular Swing Trading Strategy followed by Swing Traders in a trending market – either uptrend or downtrend.

The objective of this strategy is to capture short swings in direction of the trend and profit from it.

It looks to ride on an existing trend by entering through pullbacks or when it moves up or below key Moving Averages

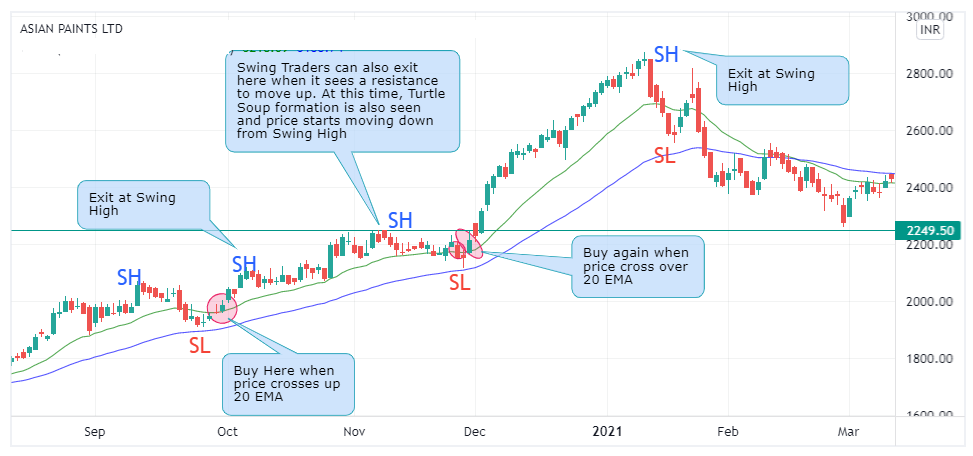

How to trade in an uptrend

- Look for pullbacks to 20/50 SMA in daily chart

- Buy after price bounces off 20/50 SMA (green candle after pullback) or after price crossed over 20/50 SMA after pullback.

- Sell at the next Swing High.

- Stop Loss below low of green candle or candle that crosses 20/50 SMA

This is explained in detail in a chart for Asian paint.

For downtrend, the steps for Short sell have to be complete opposite of the above Buy trade.

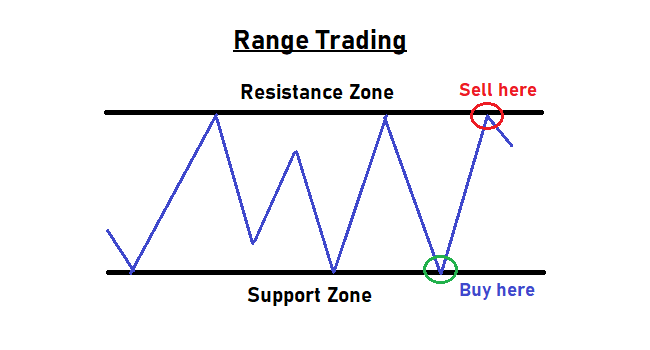

2. Range Trading Strategy

Range Trading Strategy looks to trade & benefit ranging price movement between main Support and Resistance zones of a stock.

How to Trade

- Look for Range bound market where price is moving between a major Support zone and Resistance zone.

- Buy when price pullbacks from Support zone.

- Stop Loss: Below the Support Zone

- Target Price: Sell when price reaches just before the Resistance Line.

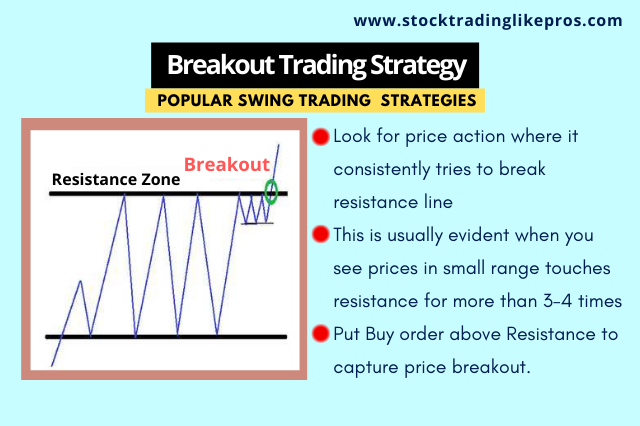

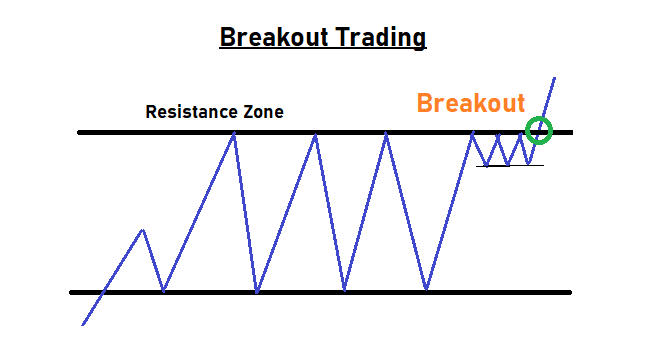

3. Breakout Strategy

This strategy is used when price breaks out of a long trading range market and gains quick momentum. The breakout is supported by heavy volume at the breakout candle.

How to Trade

- Look for price action where it consistently tries to break resistance line

- This is usually evident when you see prices in small range touches resistance for more than 3-4 times

- Put Buy order above Resistance to capture price breakout.

Advanced Swing Trading Strategies

Now, how about few advanced Swing Trading Strategies by market wizards & professional traders? These are few of my favourite strategies with very good win rate.

Let’s dig into it now…

1. Turtle Soup for Swing Traders

This is one Swing Trading strategy which has the best winning percentage for me.

“Turtle Soup” has been popularised by Market Wizard Linda Raschke & Laurence A Connors in their book “Street Smarts -High Probability Short-Term Trading Strategies”.

This is a very effective contrary trading strategy followed by Swing Traders to trap the crowd as price breaks a previous high or low and then reverses immediately.

Criteria for Buy

- 20 day new low today

- Previous 20 day low at-least 4 sessions earlier

- When market falls below the previous 20 day low, place an entry buy stop 5-10 ticks above the previous 20 day low.

Criteria for Sell: Reverse of buy condition.

Lets understand this strategy better with the below example.

Jindal Steel made a new 20 day low of 182 on 4th Aug’13 and 5 days before, it made a previous 20 day low of 187.

So, when do we buy?

Place an entry buy stop 5 ticks above the previous low of 187.

Stop Loss:

After successful buy entry at above 187, place a stop loss 5 ticks below the new 20 day low of 182.

When do I exit & book profit of the trade?

Look out for the next higher resistance above your entry point to book your profit & get out of the trade. If there is no resistance nearby, traders can protect their profit using trailing stop loss.

Here, in this trade, we can see some resistance at 210.40. So, we can exit at 210.

Isn’t this just amazing?

Looking for more successful Swing Trading Strategies followed by Advanced Traders…

Here, we go….

2. Holy Grail Swing Trading Strategy

Holy Grail Trading Strategy is again one strategy which gives high percentage of winning trade and loved by Master traders.

Again, Linda Bradford Raschke and Larry Connors popularized this strategy. This is one of my favourite Trend Trading Strategy.

It needs a trend – uptrend and downtrend for the strategy to work. It is a continuation trading strategy and hence, all buy/sell trading are to be in line with the underlying trend.

Excited?

Let’s look into how it works.

Criteria for Buy

- ADX > 30 and rising

- Look for Price retracement to 20 EMA. ADX also should turns down at this moment.

- When Price touch 20 EMA, put a Buy stop above the high of the Previous Candle.

- Put Stop Loss at newly formed Swing Low

Criteria for Sell: Reverse of buy condition.

Let’s understand this with an example for Sun Pharma where the set up is seen.

In third week of Dec’20, we saw that there was a strong uptrend in Sunpharma with ADX going above 30 and continued rising.

Then price suddenly retraced to 20 EMA in a single day with a big red candle.

Now, both our 2 criteria got fulfilled for going long and hence we will put a buy limit order above previous candle (which happens to be a small doji).

We put our buy order little above the doji candle. I can see a resistance just around the high of the doji and hence buy order is put a little over the resistance.

Our Buy order got hit on 4th day and we put a stop loss below the last swing low. Our target is the next resistance price.