Ever wondered how could Stock Market Cycle indicate the best time to buy, sell or short sell a stock?

Let’s find out…

Every stock typically goes through 4 stages of a Stock market cycle.

- The Basing Phase

- The Advancing Phase

- The Topping Phase

- The Declining Phase

Basing Phase

After a stock has declined for some time, it will lose momentum and go sideways into Basing Phase. This phase is characterized by lack of price movement on low volume as buyers and sellers are in equilibrium.

Traders are not interested in this phase due to relatively low price range bound movement (trading range between support & resistance).

If you bought at this phase, your money could be tied up with little price movement for a long time.

This is where long phase of slow buying of shares of stocks could be seen from large Institutional Investors, Mutual Funds, Banks etc..

Therefore, this stage in Stock Market Cycle is also popularly known as Accumulation Phase.

Volume will start late at the end of the phase as traders anticipate the phase to end and start the price move upwards.

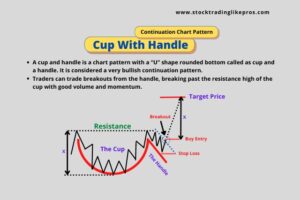

Cup and Handle pattern formation is one key chart pattern which could indicate to traders the accumulation of stocks by these investors.

Price generally move out of this phase through sudden spurt in volumes, which is generally called Breakouts.

Advancing Phase

This 2nd phase of Stock Market Cycle is also known as Advancing Phase or Markup Phase. This is the best phase to buy when a stock is moving out of the basing phase and starts to move upwards.

This is where breakouts out of the basing phase actually happen and price rallies upwards with good volume.

However, it is normal for at-least one pullback to dip back to the breakout point, before the rally advance forward.

In this phase, the 20 day Simple Moving Average usually starts turning up shortly after the breakout.

Traders should use Trendline trading Strategy during this phase.

Topping Phase

As the Stage 2 price upward movement loses momentum and starts to trade sideways, it enters into Topping Phase.

Topping Phase is also known popularly as Distribution Phase.

The initial buyers in the upward trend start to close their positions. Once again, the sellers and buyers reach a temporary equilibrium once again.

Moving averages start to flatten out with lack of price movement.

Volume is usually heavy in Stage 3 from aggressive buying and selling in equal measure.

This is the time for initial buyer to start exiting the stock and traders should refrain from fresh buying.

Declining Phase

This is the last phase of Stock Market Cycle where the equilibrium of buyers and sellers starts break down.

Also known as Markdown Phase, sellers outweigh buyers during this phase.

This is an excellent time to open a short position but initial buyers can have a torrid time as sell off can happen at a fast pace.

This sudden sell off pulls down the price further below. Moving average also starts declining.

Just like the advancing phase, there can be breakout but to the downside.

In stage 4, even a light volume can bring down the price substantially within a short span of time.

It is very important for traders to close their buy positions before the stock price enters the Declining Phase.

Never buy a stock that is in Stage 4.

To conclude, it is very important for a trader to analyze the Stock Market Cycle through detailed chart studies.

Through these studies, a trader understands the overall market action of all the participants, human emotions at every stages of the Stock Market Cycle.

Armed with this information, Traders then make critical decisions – whether to buy, sell or short sell a stock.