Ever wondered how anyone is money through short sell in Stock Market when prices are falling?

Isn’t this amazing that how traders are finding opportunity to trade when the whole stock indices or a particular stock goes on a panic downfall after a sudden negative news outbreak?

The answer like in Short Selling opportunity the market offers to every trader, whether it is Cash Market, F&O, Currency or Commodity.

Few of the best Short Sellers the world has known

- George Soros, who shorted the British Pound in 1992 and broke the Bank of England

- John Paulson, who netted $20 billion from the 2008 ‘Big Short’ crisis

- David Einhorn, who shorted Lehman Brothers in 2007-08 resulting into Lehman Brothers getting bankrupt in 2008

So, what does it mean by Short Selling?

A regular investor would only look to go long i.e. buy the stock. He would benefit only when Stock price increases from the price he bought at.

How are Short Sellers different then from investors?

Short selling refers to making sell trade entry on a stock when he expects its price to fall. As opposite to normal stock selling, in short selling, a trader need not own a stock first to short sell.

Short-sellers bet that a stock’s price will decline. It is a contrarian investor tool which bets on under-performance of a company relative to its market valuation.

Isn’t this an amazing opportunity?

Let’s understand the mechanics of Short Selling in detail.

Why should a trader short sell?

Stocks fall much faster than they rise. Have you have noticed this?

But why stock’s price falls faster than it rises?

Just because of a simple fact – we all are humans. Stock markets are driven majorly by human emotions of fear & greed. Traders & investors at slight fear & panic would look to exit quickly from their trades, much faster than they enter trades due to greed.

Hence stocks price would come down faster than they rise and traders who are able to ride on this fall make good profits in quick time.

For a short term trader, it is very important that whatever the market conditions – Trending or Range bound, he should have tried & tested trading strategies to enter the market.

The nature of short term stock trading necessitates traders to be trading a stock when its price is rising or also when price is falling. If price is expected to rise, a trader buys and when he expects the price to fall, he short sells. In short, short selling gives a trader an added ammunition to thrive in bearish or sideways market condition.

In short, short selling gives trader ammunition to thrive in bearish or sideways market condition.

So, how does traders sell short and make profits when his stock is failing.

Let’s find out…..

How does short selling work?

A Trader decides to short sell a stock when he has a bearish view of the stock.

So, how does one make money from this bearish view?

Suppose, a trader short sells a stock and enters a trade.

There could be 2 outcomes –

- Either his view is right & makes profit.

- Or his view is wrong & losses from the trade.

In the 1st case, let’s say the Trader’s view was right and stock price crashes down after he enters the short sell trade.

To book profit, he can make buy entry trade of the stock at lower price. This will closes the trade if he covers (or buys) the the entire quantity of stocks he initially short sell.

In the 2nd case, the trader’s view goes wrong and the stock’s price goes up.

So, he starts making losses from this trade.

If he has put a stop loss before, he will get exited immediately when the stop loss price gets hit. If not, he will need to exit the trade by buying (covering) the stocks.

Let’s quickly understand this with a simple example.

Let’s assume, the trader short sells 100 TCS stock at price of Rs 100.

Suppose TCS price falls down to Rs 90. He can think to book the profit at 90 and close the trade by buying the stock.

His total profit would be 100 * (Short sell price – Buy price) = 100*(100-90) = 1000.

He makes a 10% profit by short selling at Rs 100 and covering (buying) the stock at Rs 90.

Now, let’s say the other thing happens when his view gets wrong.

Suppose TCS price goes up and trader has used a stop loss at Rs 105 to protect his losses.

When price hits 105, he gets exited immediately from the stock

His total loss would be 100 * (Short sell price – Buy price) = 100*(100-105) = -500.

In both the cases, he has to exit the short sell trade by making buy entries of the stock. This is how short selling works

When is the right time to Short Sell?

Before you understand when is the right time to short sell, we need to quickly understand what is the right time for going long.

Here’s few of different events or price actions basis which a Trader thinks to buy a stock.

- Price crossing 20 SMA or 50 SMA / 200 SMA from below

- Moving Average Cross Over ( say, 20 SMA cross over 50 SMA)

- Reversal Pattern formation like Double Bottom, Inverse Head and Shoulder etc…

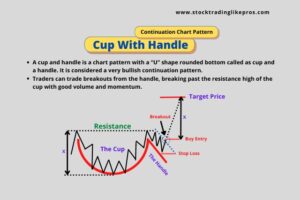

- Continuation Pattern formation like Flags, Triangle, Cup and Handle etc..

- On Pullbacks

- On Break of Resistance

- Etc…

Just as you buy stocks on different events like the few mentioned above, short selling can happen exactly when the opposite of these events occur in the chart.

So, Short Selling happens when a trader sees these events unfold on the chart.

- Price crossing 20 SMA or 50 SMA / 200 SMA from above

- Moving Average Cross Down ( say, 20 SMA cross down 50 SMA)

- Reversal Pattern formation like Double Top, Head and Shoulder Pattern etc…

- Continuation Pattern formation like Bearish Flag, Triangle etc..

- On Pullbacks

- On Break of Support

- On Break of Trendline

Let me explain this with a chart for Tata Motors.

In the above chart, we can see that Tata Motors is a big uptrend from Mar 16 to Oct’16. On 26th Oct, its prices broke the trend line.

At the same time, its price also broke below 20/50 EMA indicating a down fall from here.

A Short Seller would not have missed this opportunity and would have entered a Short Sell entry at this point.

Another Opportunity also presented soon again on 10th Nov’16, when price tried to pull back up but could not cross the resistance (major support becoming resistance now) nor the 20/50EMAs.

Now that you understood the mechanics of short selling, you need to know how to choose which stocks to short sell.

How to find out stocks to sell short?

- Look for Stock that has substantial advance in the timeframe you are trading at – preferably steep Stage 2 advance. This is a good candidate for a steep downfall when you short sell.

- The stocks should preferably be from a sector that is showing bearish sentiment lately.

- The Stock should be in Stage 3 with a flat moving average or it starts declining.

- The Stock that has been in side-ways movement for some time indicating distribution top formation.

- Check the next support level below the price. If the support level is quite close by, think to avoid the short sell. If the support level is quite far away and offer good reward / risk ratio, you should proceed with your decision to short sell.