Every trader should do a detailed planning & devise their own Stock Screener and Selection strategy.

There are many Softwares, Stock Screener & trading platforms which easily screen out probable stocks to trade as per the condition given by you.

What are Stock Screeners?

A Stock Screener is a software / platform that helps traders and investors to shortlist stocks for trading or investing.

There are fundamental screeners, technical screener, and also screeners that are a combination of both. Based on certain criteria – technical or fundamental, a screener essentially filters out stocks for traders / investors.

Since I am a technical trader, I follow Technical Stock Screeners for my trading.

Few renowned Technical Stock Screeners I like –– Chartink.com, Tradingview.com.

Apart from software based Stock Screening, Pro traders always relies on his discretionary trading (purely on his judgement, skills & gut feelings).

In trading, I feel Discretionary trading has an edge over mechanical system based trading as trading is all about emotions of all participants – the greed / fear / joy etc..

Others can debate on this. But it is just my personal view.

Discretionary Stock Screening Strategy

A discretionary traders always use their own developed Stock Screening strategies. Here’s a peek into my discretionary Stock Screening process

1. Study Liquid Stocks

Study the daily charts of most liquid stocks on the sector chosen, as part of the market study.

Liquid stocks are stocks where there are good volumes of trade and you can easily enter or exit from the trade.

2. Study price action of each stock

Do a thorough technical study of price action.

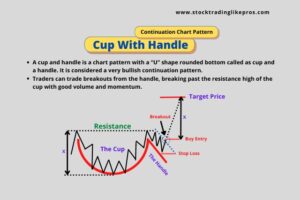

Look for chart patterns (like Triangle, Rectangle, Head & Shoulder, Double Top, Double bottom etc…).

Check the latest volume action also.

3. Stock in Trending or Range?

Check if the stock is trending or trading and check if they confirm your appropriate trade setups.

4. Trade Set Up Signals

If any stock confirms with the buy / sell signal given by your Trade setup. Continue your study further on the stock.

Eliminate stocks that do not confirm your trade setups.

5. Study Supply and Demand Zones

For the chosen stocks, draw Support & Resistance lines below and above the current price. This will help in finding out Supply/Demand for the stock.

This study will help you understand the risk / reward of the trade.

Even if a stock is a great buy, I do not select it if there is a close resistance above the current price (which indicates high probability of low reward). Also if support is very far below the current price (which indicates higher risk if the trade goes wrong).

6. Check for Divergence

Look for any divergence, if any. I prefer to use OBV indicator to check divergence.

If price and Volume have a divergence, I usually skip this stock as divergence warns me of a possible reversal of the stock trend.

7. Check Higher Timeframes

Check weekly or monthly chart (weekly for Swing Trader and monthly for position trader) to confirm your buy / sell decision.

Is there any major support or resistance you could be missing out?

If you are a Swing Trader, checking higher timeframes of day, weekly will help you ensure that you do not missed out considering these key resistances or support in your trading strategy.

8. Lastly, Confluence of other signals

Look for other confluence of signal using Candlesticks & other technical indicators like Fibonacci, Stochastic.

Hope you guys understood my stock screening process.

It is not necessary that at any time, a stock will fit any strategy. Nor any Stock Screeners give you good trades.

There will be numerable times when no stock confirms any of your stock trading strategies. During those times, it is important that you stay out of the market. Keep this in mind.

“Staying out of the market” is one of the top strategies followed by Stock Pros